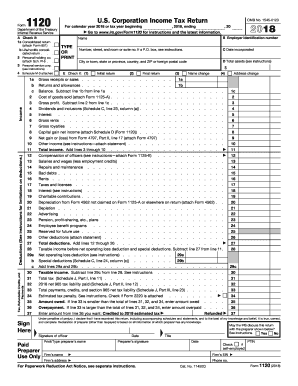

Get the free 1120 w instructions

Show details

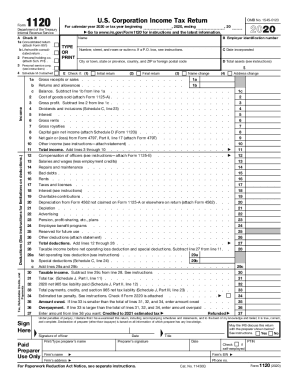

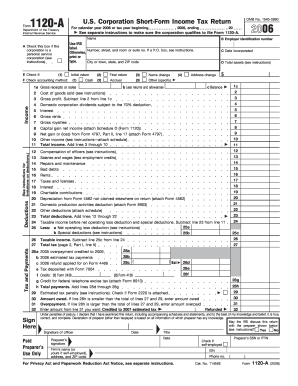

PAGER/SGML Page 1 of 22 Userid DTD INSTR04 Leading adjust -5 Fileid I1120A. SGM 27-Dec-2006 Instructions for Forms 1120 and 1120-A Draft Init. See Form 1120-C and its instructions. located in a foreign country or U.S. possession has changed. See Where To File on page 3. Corporations must include in income part or all of the proceeds received from certain corporate-owned life insurance contracts issued after August 17 2006. See the instructions for line 32g on page 12. Controlled groups must...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1120 w instructions

Edit your 1120 w instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1120 w instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1120 w instructions online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 1120 w instructions. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1120 w instructions

How to fill out IRS Instruction 1120 & 1120-A

01

Gather all necessary financial documents and records for the tax year.

02

Download the IRS Form 1120 or 1120-A from the IRS website.

03

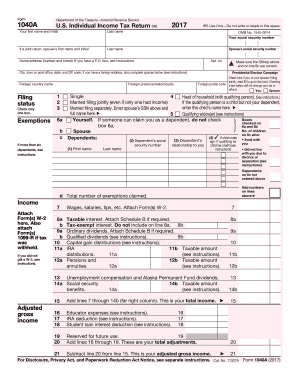

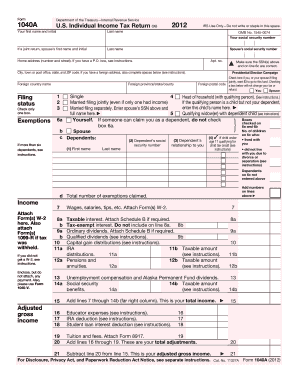

Fill out your corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

04

Report your corporation's total income on the appropriate lines of the form.

05

Deduct any allowable expenses related to the operation of your business.

06

Calculate the taxable income by subtracting total expenses from total income.

07

Apply any applicable tax credits or adjustments.

08

Calculate the total tax owed based on the corporate tax rate.

09

Complete the signature section, including the name and title of the person signing the return.

10

Submit the completed form by the due date, either electronically or via mail.

Who needs IRS Instruction 1120 & 1120-A?

01

All corporations, including C corporations and S corporations, are required to fill out Form 1120.

02

Businesses that need to report income, deductions, and credits to the IRS must also complete these forms.

03

Professional corporations and certain non-profit organizations may also need to file Form 1120.

Fill

form

: Try Risk Free

People Also Ask about

How do I file a zero business tax return?

If you had no income, you must file the corporation income tax return, regardless of whether you had expenses or not. The bottom line is: No income, no expenses = Filing Form 1120 / 1120-S is necessary. No income, but expenses = Filing Form 1120 / 1120-S is necessary.

How do I prepare my 1120-s tax return?

3:17 26:01 IRS Form 1120-S Line-by-Line Instructions 2023 - YouTube YouTube Start of suggested clip End of suggested clip So the date you you became an s corporation. The date your business was incorporated. Your businessMoreSo the date you you became an s corporation. The date your business was incorporated. Your business activity. Code your employer identification over your ein. The number of shareholders.

Do I have to do a balance sheet for 1120S?

The IRS wants to see that the balance sheet included with Form 1120 agrees with the corporation's books and records. Small corporations—those with total receipts and total assets less than $250,000 at the end of the year—are not required to complete the balance sheet in the tax return.

Do I need to file 1120S if no activity?

A corporation, including one that is taxed as an S corporation, must always file its initial tax return with the Internal Revenue Service, even if it had no business activity to report. For an S corporation, this initial return and all subsequent returns are prepared on Form 1120S – which is an informational return.

Do I have to do a balance sheet for 1120s?

The IRS wants to see that the balance sheet included with Form 1120 agrees with the corporation's books and records. Small corporations—those with total receipts and total assets less than $250,000 at the end of the year—are not required to complete the balance sheet in the tax return.

Can I file form 1120S myself?

Like most tax forms, Form 1120S can be filed electronically through the IRS's e-file system, or with most tax prep software. You can also file the form by mail.

How do I file a zero corporate tax return?

The easiest way to file your nil corporate tax return is to hire an accountant who will do it for you. That is not only the most straightforward way but the safest, because your accountant knows what information is required and can prepare all documents correctly.

How do I prepare my 1120S tax return?

3:17 26:01 IRS Form 1120-S Line-by-Line Instructions 2023 - YouTube YouTube Start of suggested clip End of suggested clip So the date you you became an s corporation. The date your business was incorporated. Your businessMoreSo the date you you became an s corporation. The date your business was incorporated. Your business activity. Code your employer identification over your ein. The number of shareholders.

Can I file form 1120S online?

More In Tax Pros Providers and Large Taxpayers authorized to participate in the Internal Revenue Service e-file program can file Forms 1120 (U.S. Corporation Income Tax Return), 1120S (U.S. Income Tax Return for an S Corporation), and 1120-F (U.S. Income Tax Return of a Foreign Corporation) through Modernized e-File.

What happens if you don't file a tax extension without filing?

Generally, if you miss the filing due date or fail to file by the tax extension deadline, the IRS may charge a failure-to-file penalty. The penalty is based on your unpaid taxes, and the IRS charges 5% of your taxes due for every month or partial month your tax return is not filed.

How to fill out 1120S form?

3:17 26:01 IRS Form 1120-S Line-by-Line Instructions 2023 - YouTube YouTube Start of suggested clip End of suggested clip So the date you you became an s corporation. The date your business was incorporated. Your businessMoreSo the date you you became an s corporation. The date your business was incorporated. Your business activity. Code your employer identification over your ein. The number of shareholders.

What documents do I need to file taxes for an S-corp?

Here is a brief overview of the tax forms a typical S corporation needs to file with the IRS. Form 2553 – S Corporation Election. Form 1120S – S Corporation Tax Return. Schedule B – Other Return Information. Schedule K – Summary of Shareholder Information. Schedule K-1 – Individual Shareholder Information.

What is the penalty for not filing an extension on time?

What Is the Penalty for Filing a Tax Return Late? If you file your 2022 Tax Return after the deadline and you did not get an extension, then you will be assessed a penalty of 5% of your balance due per month or part of a month a return is filed late (for up to five months).

How do I prepare my S corp tax return?

How to file taxes as an S corporation Prepare your financial statements. One of the first things your tax professional will ask for are financial statements. Issue Forms W-2. Prepare information return Form 1120-S. Distribute Schedules K-1. File Form 1040.

Can I submit my corporation tax return myself?

You can file your company's corporate tax return yourself or get an accountant to prepare and file it for you.

Can you file S-corp taxes yourself?

TL;DR: Yes, you have every right to do your own S-Corporation tax return, but we really don't recommend it. The amount of time you'd spend researching all the rules and regulations could better be spent doing what you do best and leaving the nitty-gritty to tax professionals like us!

What should I include with 1120S?

Information you'll need to file Form 1120S Your date of incorporation. A list of your products or services. Your business activity code. Your Employer Identification Number (EIN) The date you elected S corp status: This will be January 1 if your business operates on a calendar-year basis.

How do I fill out 1120S?

3:17 26:01 IRS Form 1120-S Line-by-Line Instructions 2023 - YouTube YouTube Start of suggested clip End of suggested clip So the date you you became an s corporation. The date your business was incorporated. Your businessMoreSo the date you you became an s corporation. The date your business was incorporated. Your business activity. Code your employer identification over your ein. The number of shareholders.

Is it mandatory to file balance sheet?

As a part of Annual e-Filing, Companies incorporated under the Companies Act, 1956 are required to efile the following documents with the Registrar of Companies (RoC): Balance-Sheet: Form 23AC to be filed by all Companies*

What tax documents do I need for S Corp?

Use Form 1120-S to report the income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an election to be an S corporation.

Fill out your 1120 w instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1120 W Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.